Saudi Venture Capital

Services

Editorial

Client

Saudi Venture Capital

Year

2021

Overview

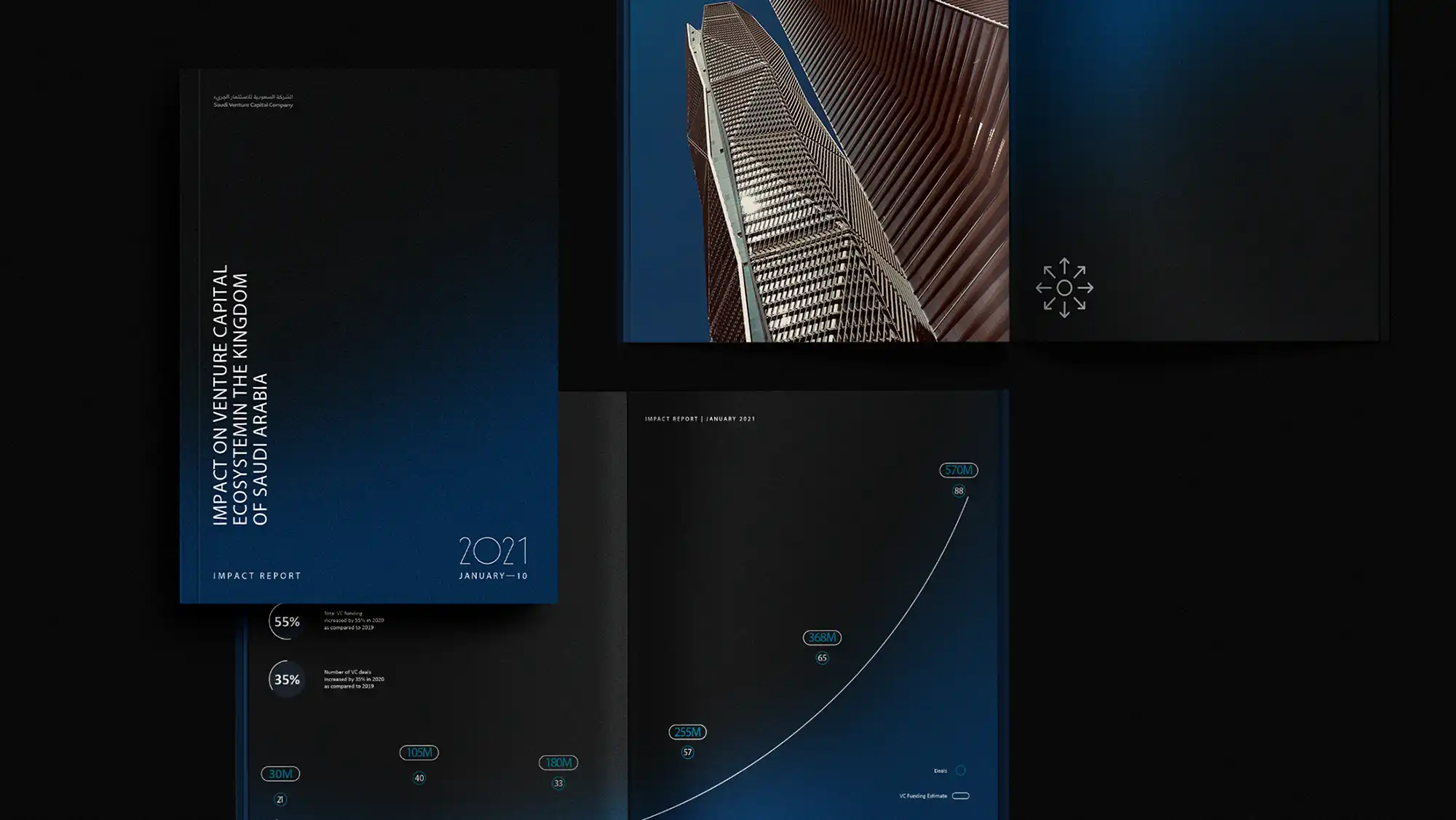

Saudi Venture Capital (SVC) is a government investment company established in 2018 and is a subsidiary of the SME Bank, one of the development banks affiliated with the National Development Fund. SVC aims to stimulate and sustain financing for startups and SMEs from pre-Seed to pre-IPO by investing $2 billion through investment in funds and co-investment in startups and SMEs.

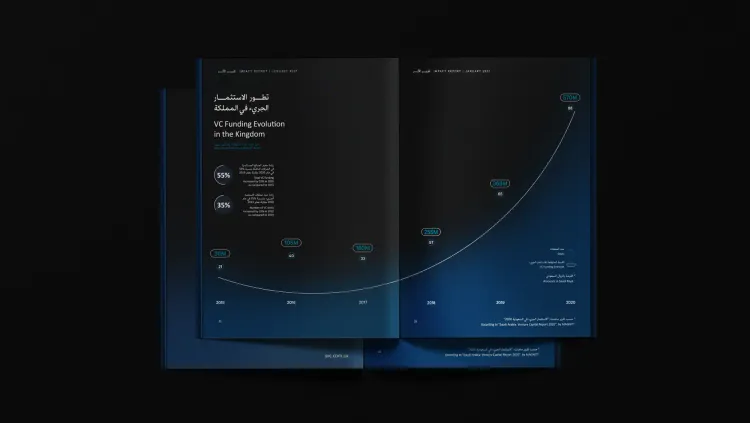

SVC has backed 43 Private Capital (Venture Capital, Private Equity, Venture Debt, Private Debt) Funds that supported 700+ Startups and SMEs via $2 billion Assets Under Management (AUM). Like all major investment companies, SVC takes prides in its portfolio.

As part of the SME Bank, SVC is obligated to submit and publish reports on the impact of their investments in VC funding and the duration of their achievements. This fulfills a compliance requirement from the SME Bank and also allows SVC to demonstrate their industry contribution and highlight their success stories.

Over multiple years, we have assisted SVC in creating an annual report. Our focus was on designing a timeless template that adheres to their brand guidelines, ensuring consistency and maintaining brand equity.

To begin the partnership, data was collected on brand assets and company information for design purposes. A Stylescape was created to establish a visual direction, and a finalized prototype and design were developed.

What we did

Combines illustration, photography and data to reflect SVC’s growth.

- Benchmarking and Research

- Proofreading and Copywriting

- Editorial Design